Spotlight on Case Studies: Successful Commercial Developments Fueled by 100% Financing

100% financing has transformed the landscape of commercial real estate by enabling ambitious projects to move forward without requiring substantial upfront capital from developers. This financing model is particularly impactful in urban revitalization, large-scale infrastructure, and mixed-use developments, where the need for substantial investment is high. Below, we spotlight several successful commercial projects that leveraged 100% financing to bring their visions to life.

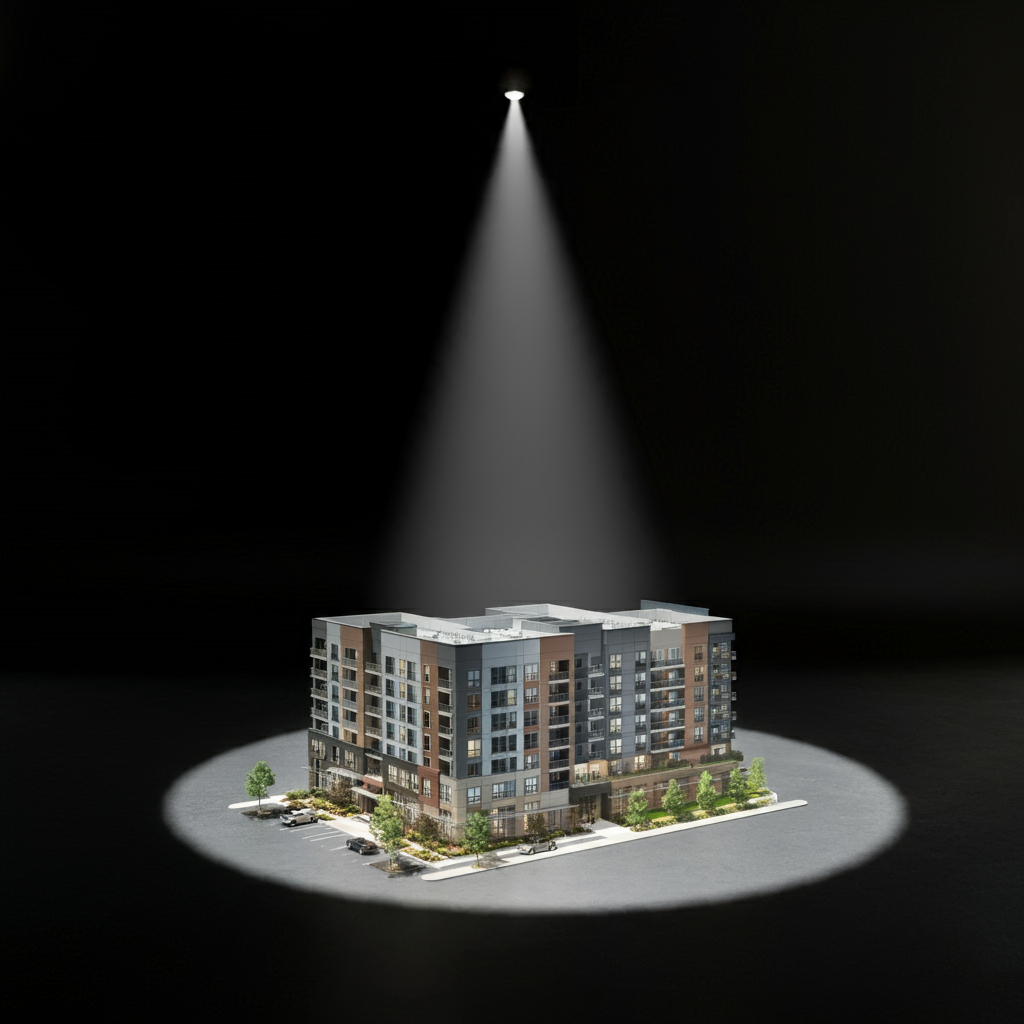

Case Study 1: Urban Revitalization in Downtown Detroit

Project Overview: A mixed-use commercial development project in the heart of Detroit aimed to transform a long-neglected area into a vibrant space featuring residential units, retail outlets, and office spaces. This project was a core part of Detroit’s urban revitalization efforts, bringing new life and economic activity to the area.

Financing Approach: The project leveraged a combination of public-private partnerships and 100% financing, provided by a blend of government grants, opportunity zone funding, and tax credits. By tapping into these resources, the developers secured full funding without needing significant private capital.

Key Success Factors:

- Government Incentives: The project qualified for federal and state tax credits, which made full financing possible. This reduced the financial burden on the developers and allowed the project to attract community-focused investors.

- Social Impact and Economic Boost: The development brought affordable housing and created jobs, garnering support from both public entities and local investors.

- Outcome: The revitalized area experienced a 30% increase in property values, a surge in local business activity, and higher occupancy rates, making it a successful example of urban revitalization through 100% financing.

Case Study 2: Sustainable Office Complex in San Francisco

Project Overview: This project involved the development of a high-tech, eco-friendly office complex in San Francisco, designed to meet LEED Platinum standards and utilize sustainable energy sources. The complex would cater to tech firms and start-ups, featuring energy-efficient design and on-site green amenities.

Financing Approach: The project was fully financed through a combination of green bonds, government grants, and venture capital from impact investors focused on environmental, social, and governance (ESG) initiatives. This 100% financing model aligned with the project’s sustainability goals, making it an attractive option for ESG-focused investors.

Key Success Factors:

- Green Bonds and Grants: The project received federal and state grants for sustainable development, which, combined with green bonds, covered the total cost of development.

- Appeal to Tech Tenants: The sustainable features attracted high-profile tech tenants interested in eco-friendly workspaces, ensuring full occupancy upon completion.

- Outcome: The project not only met its financial goals but also set new standards for green building in commercial real estate, attracting more investors to similar eco-focused developments.

Case Study 3: Logistics Hub in Atlanta

Project Overview: Recognizing the growth in e-commerce, this project focused on creating a state-of-the-art logistics and distribution center in Atlanta. Strategically located near major highways and rail lines, the hub would streamline logistics for large retail companies and cater to the region’s increasing demand for distribution facilities.

Financing Approach: 100% financing was achieved through a joint venture between a private equity firm and a logistics REIT. The financing structure allowed the project to proceed without the developer needing upfront capital, while the REIT provided expertise in logistics and operational management.

Key Success Factors:

- Strategic Location and Market Demand: The location and the demand for logistics space attracted large retail clients, ensuring profitability and a steady revenue stream.

- Experienced Partners: Partnering with a logistics-focused REIT added industry expertise, further enhancing operational efficiency and cost management.

- Outcome: The hub became a key distribution point for national retailers, reducing delivery times and costs. This success underscored the potential of fully financed logistics hubs in high-demand markets.

Case Study 4: Affordable Housing and Mixed-Use Development in Chicago

Project Overview: Aimed at addressing the affordable housing crisis, this mixed-use development in Chicago provided affordable residential units alongside retail and community spaces. The project prioritized accessibility and community impact, serving as a model for mixed-use affordable housing.

Financing Approach: The developers utilized 100% financing through a combination of municipal bonds, government grants, and tax-exempt debt. This structure enabled them to offer affordable rental rates without sacrificing project quality.

Key Success Factors:

- Public-Private Collaboration: Collaborating with local government and nonprofits made it easier to access grants and bonds specifically designated for affordable housing.

- Community Support and Demand: The project received overwhelming support from the community, with high occupancy rates and demand for commercial spaces.

- Outcome: The development provided much-needed housing for low- to moderate-income residents, boosting local economic activity and demonstrating the success of public-private financing models in affordable housing.

Case Study 5: Hospitality and Tourism Development in Miami

Project Overview: This project centered around creating a luxury hotel and resort in Miami, designed to attract both domestic and international tourists. The resort included high-end amenities, entertainment venues, and green spaces to create an attractive, all-in-one vacation destination.

Financing Approach: 100% financing was secured through a tourism investment fund, supported by both private investors and government tourism grants. The fund’s structure allowed the project to move forward with comprehensive funding, taking advantage of Miami’s thriving tourism industry.

Key Success Factors:

- Targeted Market Demand: Miami’s strong tourism market created demand for the project, helping secure the necessary funding from tourism-focused investors.

- Government Support: Local tourism grants and incentives were key to achieving 100% financing, with a focus on enhancing Miami’s position as a top tourist destination.

- Outcome: The resort has since become a popular tourist spot, delivering high returns and attracting international interest, showcasing the viability of fully financed hospitality projects in tourist-heavy regions.

Leave A Comment